Are your goals and your dreams for your life written down? If not, they should be! I allow my mind to relax and focus on my dreams. I write them down, read them out loud, and rewrite them several times to confirm that I want to achieve them. This becomes my purpose in life. I determine what needs to be in place to achieve those dreams. Here is a simple, very popular goal writing technique that I like.

Goal writing process

Start with the process below to determine what needs to be in place to achieve your dreams.

1. Write the dream, mission statement, objectives, desires, whatever you wish to achieve.

2. Determine what items that need to be place that are not there yet. These will be your action items. Start each sentence with “To.” Example; Goal: To paint the railing red.

3. Write out each goal that needs to be achieved.

4. Test each goal to ensure it is written correctly by using the S.M.A.R.T. technique below

Test each goal by asking the following questions:

1. S – Is the goal specific? Painting the railing red is specific. We know which railing, what colour, and the action that is needed.

2. M – Is the goal measurable? How do you know when the goal has been achieved? We know when we succeeded in painting the railing red when the railing is painted red. It’s a yes or no scenario.

3. A – Is the goal attainable? Well, if I wanted to paint the railing red, but don’t have access to that colour of paint, then it will be impossible to achieve it. The same is true if I wanted to paint the railing red in an hour when the railing spans over three city blocks.

4. R – Is the goal realistic or relevant? If painting the railing red doesn’t contribute to my dream, then achieving it would be irrelevant. Perhaps the cost of painting the railing red would bankrupt me, then it would not be realistic to do it and perhaps it needs to be rewritten or simply abandoned.

5. T – Is the goal timely? My goal doesn’t have a timeframe, so my goal fails the test. I could rewrite the goal and add “by Friday.” This newly written goal would need to be tested again to ensure it meets the SMART test.

I like this approach to writing goals. I hope you enjoy it too! Brought to you by your friendly neighborhood Hamilton accountant.

Keep things simple!

HST simplified

As an accountant, here in Hamilton, Ontario, I have many of my clients ask questions about HST because they don’t understand it very well even though the Canada Revenue Agency (CRA) are doing a good job presenting the information. If you feel this way, you are not alone.

HST

HST is the harmonized sales tax in Ontario. It’s the combination of a federal sales tax of 5% and a provincial sales tax of 8% to make 13%. They simplified the process by joining these. If your sales are greater than $30,000 then you must register for HST or you can elect to register if you sell less. Contact CRA for the HST# and confirmation that you qualify.

How does it work?

We, business owners, create sales and if registered, we must charge the 13% of our sales. For example, if we sold $100 of goods, we must charge $13 of HST. We are the custodians of the government’s money so we must not use this in our business activities or for personal use. The government recognizes the double taxation of the HST if we only pay what we collect so they setup the input tax credit (ITC). To simplify this, the ITC is the HST we paid to our suppliers. We deduct the ITC from the HST Collected and then remit the difference. If you have more ITCs than HST Collected, you get a refund.

HST guidelines on ITC amounts

The HST collected is straightforward so I want to focus on the ITC. When doing your bookkeeping, you must separate the HST from all activities. Not all items are subject to HST. Here are a few tips to help guide you through this.

1. When doing your bookkeeping, look at the invoice to be paid. If there is HST charged, it must have the HST# clearly identified. Not all suppliers have to charge HST.

2. Here are some items that are exempt from HST so no HST can be charged

a. Insurance – Even though there is 8% PST, this is expensed and not added to the ITC

b. Interest

c. Taxes – Property taxes, excise tax, HST, Income tax, etc…

d. Bank Fees – These are not taxed but watch for cheque books and other types of supplies provided by the banks

If you have any questions, call your accountant. This is brought to you by your friendly neighborhood accountant.

Keep it simple!

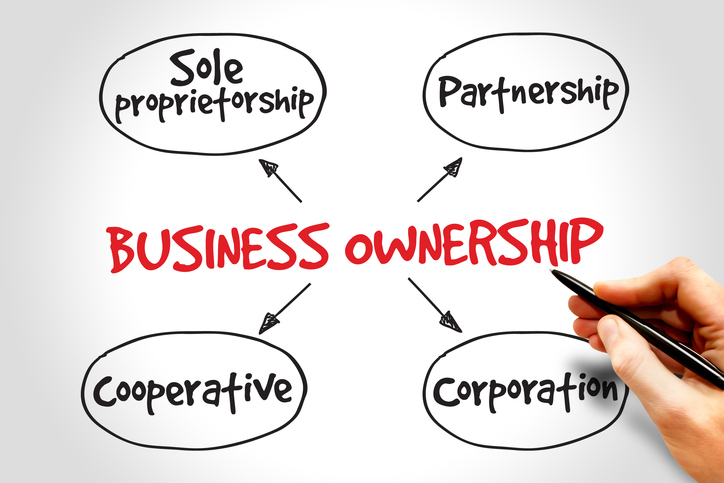

Sole Proprietorship vs Corporation

Many people want to know if they should incorporate or start a sole proprietorship (business). As an accountant, here in Hamilton, Ontario, I want to help people decide. I want to focus on some of the many reasons to incorporate; For the most part, whether you have a business or corporation, the concept of running a business is the same. So why incorporate?

Reasons for incorporation

My reasons are for those who are starting up a small business or thinking of transferring to a corporation. Yes, you can transfer your small business to a corporation, so you don’t need to start one now. The larger companies are already incorporated and have different reasons for creating, merging, and selling corporations. I want to focus on you.

Here are some of the reasons for incorporating.

Taxes – If you are choosing to keep the profits in the business, then using a corporation will allow you to keep most of it because of the lower tax rate (approximately 13% tax rate in Ontario). If you pull out all the money of the corporation in forms of salaries or dividends, and your personal tax bracket is already at 42%, then the taxes of the profits of a sole proprietorship or the salaries and dividends of the corporation start at that rate. Leave the money in the corporation for a later date. You can always payout the after-tax profits with dividends. There are other tax advantages that can help such as personal use of a car for business purposes.

Limited liability – Some believe that corporations create a shield between them and possible lawsuits. Being incorporated doesn’t stop potential lawsuits but having a corporation and insurance does create some protection against the loss. There are times when this protection doesn’t apply. Here are some thoughts of items that hold the director liable:

• Any personally guaranteed loans or mortgages

• Any frauds committed

• Source deductions for payroll

• HST filings and remittances

Marketing – You can lock in your business name when registering the name as the corporation. Some companies refuse to deal with businesses that are not incorporated. This opens that market.

Legacy – If the business continues after you are finished with it, it has the business name that you created.

Investors/partners – If you wish to add investors, it’s easy to sell shares, even non-voting shares.

There are more reasons and I hope this information helps. Brought to you by your friendly neighborhood accountant.

Keep it simple!

Credit Cards! To use or not to use?

Credit Cards have many uses and can be beneficial and useful, but they can be harmful and detrimental to your financial wellbeing. It’s a double-edged sword; on one side, we get the benefits of deferred payments for a month, points to be used later, online purchase functionality, and the protection of buying products and services. On the other side, the interest rates are high if you carry a balance, it goes back to the date of purchase, which removes the benefits of the one-month deferral, and you’re buying with future money that you might not have.

How to take advantage of the credit cards.

As an accountant, I believe that most debt is bad debt. When I say that, I mean that debt for the sake of investing is acceptable debt, all other debt is taboo, but that’s another story for later. Let’s talk about the benefits of credit cards and how we take advantage of them.

1. Never carry a balance on your credit cards. If you are going to incur debt, get a line of credit (LOC) and pay off the credit card on time to reduce and avoid unnecessary interest.

2. Pay your credit cards on time. Paying your credit cards on time prevents a charge of interest from the date of purchase. When using a LOC, the interest starts from the date of payment instead.

3. As you can see, interest is your enemy. Negotiate or find a credit card that has a low interest rate in the event a payment is missed or late. This will minimize your exposure of too much interest.

4. Take advantage of the points offered by the credit card companies. This means you need discipline to ensure you make your payments on time and don’t carry a balance on them.

5. Plan your purchases on the credit card. If you know, you will buy a TV soon, shop around for the best price and save money to make your purchase. When you have the money, buy the item on your credit card, and then pay it promptly. This will save you from impulse buying. We are an instant, self-gratifying society that can’t wait for our material items.

6. The purpose of a credit card has changed over the years. They replaced in store credits and made the credit independent so that it can be used anywhere. I have one credit card for points and a second credit card mostly for emergencies in the event they don’t accept the type of card I have for my main purchases.

In summary, don’t keep a balance on your credit cards but use them to take advantage of the points. This requires discipline to spend only the money you have. Keep good spending habits brought to you by your friendly neighborhood accountant.

Keep it simple!

Sell Sell Sell

The most important part of all businesses is the ability to sell. We can spend money easily and freely and we might think that spending can be challenging given that we need to spend in the right places for the right things, but without sales, we don’t have the money to buy things without dipping into our personal lives.

How to sell

As an accountant in Hamilton, I’m not immune from the need to sell. My business comes from referrals mostly, but yours might not. For me to succeed, I need to provide exceptional, high quality service. When people like me, they tell their friends. I believe in caring for my clients and that’s how I grow my business.

What about the selling process? The best approach to creating a sound selling process is to do your homework. There is no hiding from it. Research your competitors and see what they do. They sell and market based on what works especially long established businesses. They made the mistakes and did the trials. If you are doing exactly that then maybe, it’s your closing techniques.

All sales need a closing, whether it is a simple node on confirmation of the purchase, or a direct question asking for the sale. We can’t be fearful of asking for the sale such as, “How would you like for me to package this?” or “May I place the order?” I went to a store several weeks ago where a salesperson met me as soon as I walked into the store and they did their job beautifully. They provided a need, they created a trust, they demonstrated a perfect fit for my purposes, but they didn’t ask for the sale. I was confused and lost. I thought he wanted to sell me the product but felt he wasn’t interested. I felt I would be rude if I blurted out that I wanted to buy it. I thought it was his job to ask for it. He didn’t, I left.

Don’t ask too soon but be sure to ask! Close the sale. Keeping selling, brought to you by your friendly neighborhood accountant.

Keep it simple!

The Search for Financial Freedom

I searched for years to determine what I truly wanted in life. When I discovered it, I also discovered that I needed to be financially free to achieve it. How do I become financially free and what is financial freedom?

Financial Freedom

I define financial freedom, a.k.a. financial independence, as having enough income to pay for a desired lifestyle without working. Some people want to work and that’s fine and totally acceptable if you can achieve your desired life, lifestyle, and the freedom to enjoy it. Working all the time to generate the income necessary to achieve the desired lifestyle but not being able to enjoy it is a shame. Personally, I would rather earn a sustainable income so I can have the free time to enjoy my life.

How to achieve Financial Freedom?

Some of you heard the term “make your money work for you.” This is true, let me share a few ideas, but perhaps not all would be suited for you.

As mentioned before, the income is directly determined by your desired lifestyle so you’ll need to write your story of how you live your life and what you do with it whether it be travelling, writing novels, helping others, or simply laying on a beach at a tropical location all year long. Reducing your lifestyle while increasing your income also works well.

Now that you wrote out your desired lifestyle with all the money requirements to achieve it, we can now look how to generate that income from non-working sources. Some will need an investment to accomplish hence the term “you need money to make money.” This term only applies to investment income and not necessarily to all scenarios. Exchanging time for money, a.k.a. working, creates money without the need of money to achieve it.

Let’s get to it, shall we? Here is a short list:

• Rental income from a house, a car, equipment, etc.

• Borrow money then lend it out at a higher interest rate

• Run a business and make it self-sufficient

• Get contracts and sub-contract the work

• Investment income such as GIC’s and mutual funds

Look for opportunities to generate passive income. These ideas are from your friendly neighborhood accountant.

Keep it simple!

O Canada or Oh! Canada

I celebrated Canada Day and reflected on some of the people who make up our country. This brought back memories of acquaintances who came to Canada for a better life.

I spoke to many immigrants in my life but never met up with a refugee or at least no one brought to my attention that they escaped from their homeland. For those I met and those I’ve heard their story, they not only struggled at home but struggled even more here, in Canada. When I spoke to them, they tell me they came to Canada for a better life, especially for their family. Some are dentists and others are doctors but in both cases, Canada didn’t recognize their education and experience here so they would have to repeat most of their education process.

Come to Canada!

My understanding and perspective of the invitation given to people of other countries is that this is a great country to live. I agree, this is a great Country and I’m proud to be Canadian and I’m proud to be part of its culture and meaning. I Love it that other countries sees us as polite and kind.

Many immigrants try to attain a job here but since their education and experience do not qualify, they try to find any form of employment to survive while their children attend school. Most of these people are educated and quite intelligent so they try their hand at being an entrepreneur. They invest all their money they brought with them, as prescribed by our government, into a franchise or their own startup company. They work hard, very hard, to be successful.

I heard of a person who escaped bullets with their family in the trunk of their car. They came to Canada, started a business and it grew to three plants, one in Canada, and two in the United States. They sold their business when he retired. As an Accountant here in Hamilton, I’m proud of new Canadians making a difference. Let’s extend our pride for all Canadians, new and previous generations.

Keep it simple!

Building Bravery or Business Blunder

Building Bravery or Business Blunder

A client approached me the other day and asked me if he had to pay the HST on a purchase of a commercial building. This brought to my attention that many of my clients ask the same question. I hope realtors and purchasers of businesses and/or commercial buildings don’t blunder.

Who wants to pay the high HST amount if they can avoid it?

As you can imagine, the HST portion on a commercial building or on a purchase of a business, can be very large especially when the business or property is in the millions of dollars. Even though the HST is deductible as an input tax credit for those registered for HST, the purchaser needs to finance it and there is a cost to the financing, especially if there is a long delay in getting the refund from the government.

For those who are not familiar with HST, the business remits the net difference between what they collected and what HST they paid. For example: Let’s say a business had sales of $1,000 and collected $130 of HST. They had $600 of expenses, which they paid $78 of HST. They remit the remaining amount ($130 – $78 = $52) to the government. This is called an HST return and the date due depends on the situation of the business, some monthly, some quarterly, and some yearly.

Both registered for HST?

Canada Revenue Agency (CRA) recognises the challenges of finding the extra money for the HST portion of a purchase so they created a provision that allows purchasers to be exempt.

Purchase/Sale of a business

For the purchase of a business, use form GST44, which allows you to be exempt from paying the HST for the acquisition of a business or part of a business. Have the offer include a provision for this form and that both of you, the seller and buyer, agree to the transaction. Fill the form and ensure each of you have a copy. Both of you send this form to your tax centre when filing your next HST return.

Purchase/Sale of a commercial building

For the purchase of a commercial property for the use as a commercial activity, enter the amount of HST on Line 205 of your HST return and include this amount in line 108. Have the offer include a provision that both of you, the seller and buyer, agree to the transaction. File your return.

I hope business owners don’t finance the HST on a purchase of a commercial building or business.

Keep it simple!

Where is my business going?

I visited the Concession Street Fest on the weekend, and the energy and friendly people in their kiosks selling their products delighted me. While I was there, I spoke to a few merchants about their business. One person I spoke to said to me, and I quote “I don’t need an accountant, I’m too small.” It concerns me that people think that an accountant is only for the rich and successful. All businesses, great and small, need an accountant to help them become the rich and successful. I learned that 50% of business owners lack the financial knowledge to operate a business successfully. This, to me, is the leading cause of business failure. I wish to focus this blog on the first step to a financially successful business, to have a solid direction.

So where is your business going?

Understanding the direction of your business helps guide you to good business decisions and allows you to measure your success against it. Without it, the business is aimlessly drudging on to nowhere. Take the time and write out your purpose for the business.

How?

Start with defining your dream, a moment in time far in the future, where there are no limits and no timelines. Can you see what your business has become? Can you visualize its purpose? Good! This is your dream. What do you need to do to make that happen? This is your mission.

Write you mission, keep it simple and to the point. There are plenty of examples on the web that can help you do this, but they all miss the critical point important to each of us, and that is dreaming. They cannot dream for you. This is our baby, only we can do that.

You wrote your mission statement; now ask the question “What needs to be in place to make that happen?” These are your goals, your action items, your to-do list.

Keep it simple!

What to do with a review letter from CRA?

The answer to this question is not as stressful as some people think. The Canada Revenue Agency (CRA) is simply asking for confirmation of information. It is best to read the letter to determine if it’s an audit or simply a review. The audit will request information and an appointment to review your information while the review is a request to supply them with the supporting documents for your deduction or income slips. It is highly recommended to seek out an accountant rather than a tax preparer to answer the audit letter. The tax preparer or you can answer the letter for the review.

CRA does only seven types of reviews; Pre-assessment, Processing, Request Verification, Refund Examination, Supplementary Examination, Matching, and Special Assessments. Even though they appear to be many, they all have the same thing in common; they want confirmation of information. In general, we receive the review letters and answer them without the client’s knowledge except the special assessments, where the clients receive those directly. We advise our clients to come in and we will answer the review together.

You are probably wondering how tax returns are selected for review. As per the CRA website, there are several reasons for a review such as the return does not match slips provided by third-party sources, the types of deductions or credits claimed, your compliance history, random selection, and more.

The best approach to answering these letters is to read them carefully, get a full understanding of what they are asking for, get copies of the requested supporting documents, and respond in a timely manner, don’t delay. There is nothing to fear as long as you prepared your tax returns honestly. Keep your returns for seven years in case of a review, including all receipts, bank,statements, cancelled cheques, and any other documents that support your claim.